- #FISSION URANIUM CORP MERGER PRO#

- #FISSION URANIUM CORP MERGER PLUS#

- #FISSION URANIUM CORP MERGER PROFESSIONAL#

- #FISSION URANIUM CORP MERGER FREE#

#FISSION URANIUM CORP MERGER FREE#

Its US mining division was acquired by Energy Fuels in June 2012, leaving the company free to focus on other areas including its 60%-owned Wheeler River project in the Athabasca Basin. Activities at Waterbury have been carried out in conjunction with Fission's 40% joint venture partner, the Korean Electric Power Company-led Korea Waterbury Uranium Limited Partnership consortium.ĭenison owns a 22.5% interest in the McClean Lake uranium mill in northern Saskatchewan, as well as exploration and development projects in Saskatchewan, Zambia and Mongolia.

#FISSION URANIUM CORP MERGER PLUS#

Its J Zone deposit is currently estimated to contain N I43-101-compliant indicated resources of 10.3 million pounds (3960 tU) plus 2.7 million pounds U3O8 (1040 tU) of inferred resources. Waterbury Lake is immediately adjacent to Rio Tinto's Roughrider uranium deposit. "The acquisition of Waterbury will allow Denison to expand its exploration efforts in the area of our Midwest uranium deposits with a significantly enhanced land package," he said. Under the leadership of Fission's current management team, NewCo will hold about C$18 million ($18.3 million) in cash and will be fully funded to continue future programs at Patterson Lake South and elsewhere.ĭenison president and CEO Ron Hochstein said that the transaction satisfied his company's corporate objectives.

#FISSION URANIUM CORP MERGER PRO#

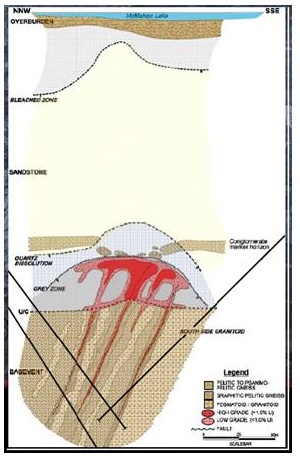

On completion, Fission's shareholders will hold approximately 11% of Denison.Īs a condition of the acquisition, some of Fission's assets, including a 50% interest in the Patterson Lake South property in the western Athabasca basin, will be spun out into a new company, currently dubbed NewCo, to be held pro rata by current Fission shareholders. The transaction, which will see Fission shareholders offered shares in Denison, values the assets at approximately C$70 million ($71 million). Dear retail investor, your positions can go 20% - 30% lower in the coming weeks/months, but it could also go 30% higher all of a sudden (in one trading day) when: ⁃ big positions are taken ⁃ shorters buy the shares needed to give those shares back that they borrowed to be able to short earlier ⁃ the U3O8 price all of a sudden starts to increase fast (phase2 and phase3, Cameco, Orano, Kazatomprom buying U3O8) Those short term fluctuations don't matter if you look at the multi-bagger potential in the coming years $NXE $DNN $CCJ $UUUU $URG Paladin Energy, Peninsula Energy, Boss Resources, Fission Uranium Corp, Goviex Uranium, Global Atomic, UEX Corp, Forsys Metals.Denison Mines is set to expand its exploration scope in Canada's Athabasca Basin through a newly announced acquisition of uranium exploration company Fission Energy.ĭrilling from the surface of Waterbury Lake (Image: Fission Energy)Ī binding letter of intent will see Denison acquire uranium projects including Fission Energy's 60% interest in the Waterbury Lake uranium development, as well as Fission's exploration interests in other properties in the Athabasca Basin, its interests in two joint ventures in Namibia and its assets in Quebec and Nunavut.

#FISSION URANIUM CORP MERGER PROFESSIONAL#

So let's scare retail investors in the premarket to create volume in favor of professional investors.

But they want to invest big amounts and that's not so easy in a tiny sector. Why? The uranium market is a very tiny sector to invest in and at this moment professional investors want to take position in several uranium companies (phase1). Premarket data is an easy way to manipulate sentiment of daytraders :-) But when you take the time to understand the uranium market, you laugh at this stage. It's funny to see that some short term investors get scared from premarket data.

Thus a record U308 supply deficit is going to collide with the nuclear renaissance… remember the cost of fuel for a nuclear plant is a small part of its Opex… hence the will pay whatever it costs to obtain the fuel… interesting set of dynamics …. The supply deficit could reach 90 mln Lbs. They will have to ‘oversupply’ the enrichers they have which ultimately mean an amplified demand for UF6… but UF6 is running out …thus more conversion of mined U308 is required … but there are not enough idle and operating mines to meet the forthcoming demand and it takes years to bring a mine on stream. With the previous over supply of UF6 evaporating and demand increasing there is going to be a bottle neck with enrichment as the West does not have enough enrichment capacity. Demand this year for U is around 200 mln Lbs. With this going off line the enrichment process will be under pressure. Russia was responsible for approx 35% of the supply. This has, post Fukushima been shorter due to over supply of UF6 (enriched pre-pellet).

There’s a 2 year time from a user ordering fuel to receiving it.

0 kommentar(er)

0 kommentar(er)